The shipping industry and its global fleet have seen continuous growth over the years. According to the latest data from the United Nations Conference on Trade and Development (UNCTAD), by the end of 2023, the total deadweight tonnage (DWT) of ships over 100 GRT (Gross Register Tonnage) reached approximately 2,273 million DWT.

A significant portion of this capacity is attributed to the world’s fleet of dry bulk carriers, which alone accounts for 974 million DWT. This represents almost 43% of the global fleet’s deadweight, underscoring the critical role dry bulk carriers play in international trade and the transportation of goods.

Among the vast array of companies operating within this sector, the top 10 largest dry bulk shipping companies command a substantial share of the market. Together, they operate 10.67% of the dry bulker fleet’s deadweight, with a combined total of 989 ships. Leading the pack is Golden Ocean Group Ltd, which stands out as the world leader in dry bulk shipping, boasting ownership of 81 vessels and an impressive fleet deadweight of 14.1 million tons.

Here is the list of the top 15 largest dry bulk shipping companies by fleet deadweight owned:

| Company Name | Number of vessels | Fleet deadweight, DWT |

|---|---|---|

| Golden Ocean Group Ltd. … | 81 | 14109774 |

| Oldendorff Carriers | 131 | 12954160 |

| Star Bulk Carriers | 113 | 12716233 |

| PAN Ocean | 81 | 11257659 |

| Navios Maritime Partners. … | 71 | 9173758 |

| Maran Dry Management | 42 | 7960737 |

| Pacific Basin | 115 | 5237570 |

| Genco Shipping & Trading Ltd. … | 46 | 4997089 |

| Diana Shipping | 43 | 4821511 |

| Safe Bulkers | 47 | 4800000 |

| Fed Nav | 97 | 4228915 |

| Eagle Bulk Shipping Inc. … | 52 | 3162004 |

| Seanergy Maritime Holdings | 17 | 3054820 |

| Eastern Mediterranean Maritime Limited | 41 | 2978559 |

| Himalaya Shipping | 12 | 2520000 |

This article draws upon open-source data from major players in the global market for dry bulk cargo transportation. We have meticulously compiled information on the number of owned and bareboat-chartered vessels, along with their deadweight capacity. The methodology behind our data collection and analysis is detailed at the end of this article.

It’s important to note that the figures presented here exclusively cover the companies’ fleets of dry bulk carriers. Assets such as oil tankers and container ships are excluded from this analysis and are reviewed separately in articles dedicated to the top oil tanker and container shipping companies, respectively.

1. Golden Ocean Group Ltd.

Golden Ocean Group Ltd. has risen to become the leading dry bulk shipping company, with a fleet that includes 60 Capesize and 34 Panamax class bulkers. Despite selling 3 Panamax vessels, its fleet boasts a significant deadweight of approximately 14.1 million tons. The company’s fleet features six 210,000 DWT Capesize bulkers from Bohai Shipbuilding Heavy Industry Co., Ltd., highlighting its emphasis on large and efficient vessels.

To enhance its fleet’s efficiency and environmental performance, Golden Ocean Group is introducing 7 new Kamsarmax class ECO-type vessels, expected to be delivered in 2023. These additions aim to reduce emissions and increase the fleet’s carrying capacity and earnings potential, as emphasized by CEO Ulrik Andersen. This strategic expansion underscores Golden Ocean’s commitment to leading the dry bulk sector through innovation and sustainability.

Here is the Golden Ocean Group fleet list headed by six 210,000 dwt Capesize bulkers delivered by the Buhai shipyard – Bohai Shipbuilding Heavy Industry Co., Ltd.

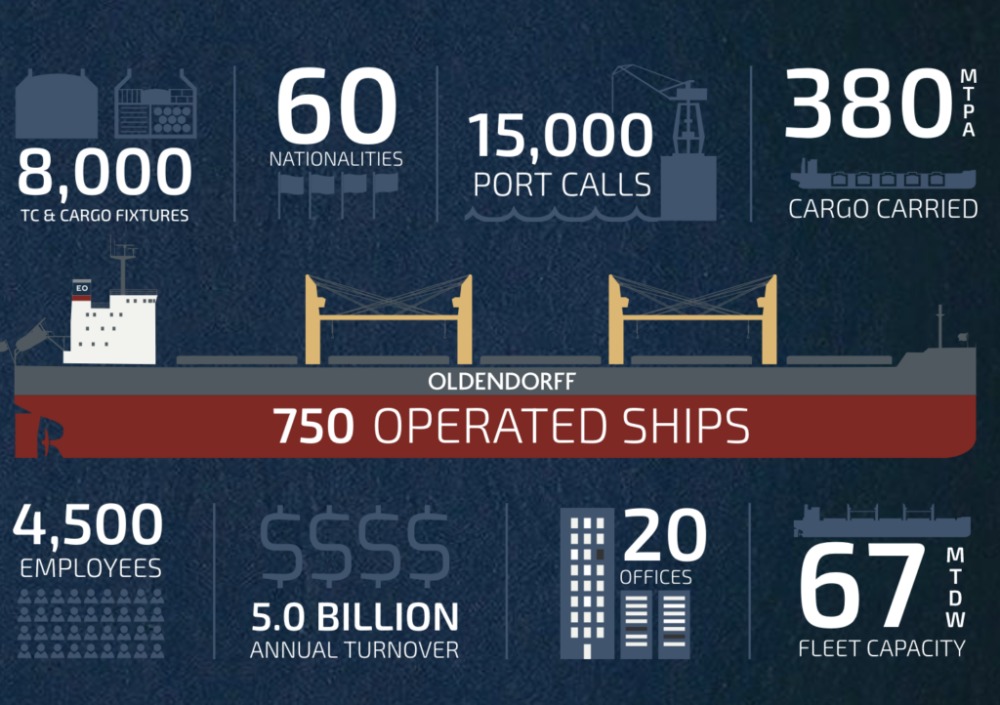

2. Oldendorff Carriers GmbH & Co. KG

Oldendorff Carriers stands out in the dry bulk shipping sector, notably for its fleet of 25 Newcastlemax class carriers contributing over 5.2 million tons of deadweight. Despite a significant portion of its fleet being time-chartered, its owned and bareboat chartered vessels firmly establish its industry prominence.

The company’s transshipment operations, initiated in 2001 in Turkey with over $600 million invested, feature an extensive array of assets including transshipment platforms, floating cranes, and tugboats. This enables efficient handling of over 200 million metric tons in shallow waters globally.

Annually, Oldendorff transships about 400 million tons of cargo, including coal, iron ore, and bauxite across 11 locations worldwide. This operational diversity and strategic asset management underscore its leading position in the dry bulk sector.

It is worth mentioning that Oldendorff also operates an even more significant fleet of about 550 time and voyage chartered vessels, bringing its total fleet to approximately 680 vessels at the beginning of 2024. This extensive operation further highlights Oldendorff’s vast presence and capability in the global dry bulk shipping market.

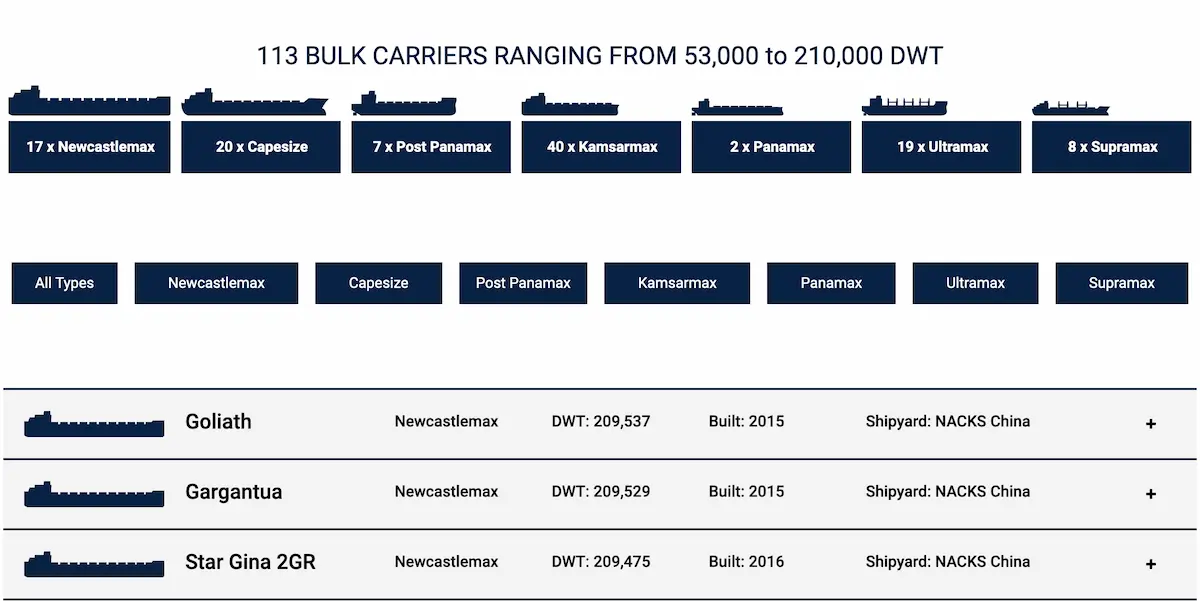

3. Star Bulk Carriers

Star Bulk Carriers Corp. ranks as the third-largest dry bulk shipping company, boasting a vast and modern fleet of 113 bulkers with a total deadweight of 12,716,233 tons. The company’s fleet is headlined by the “Gargantua,” a colossal Newcastlemax type bulk carrier measuring 300 meters in length and with a deadweight of 209,529 tons, surpassing the size of any vessel in Oldendorff Carriers’ fleet.

The Star Bulk fleet’s diversity is further highlighted by the inclusion of two additional Newcastlemax class bulkers, the MV Star Gina 2GR and MV Maharaj, each boasting over 209,000 tons DWT. These ships are part of Star Bulk’s impressive lineup of 17 Newcastlemax vessels. The company’s operational versatility is enhanced by a mix of 20 Capesize, 7 Post Panamax, 40 Kamsarmax, 2 Panamax, 19 Ultramax, and 8 Supramax class bulkers.

This diverse fleet composition enables Star Bulk to transport over 60 million metric tons of various commodities, including iron ore, grains, bauxites, and fertilizers, globally for their clients. Star Bulk’s strategic fleet management and diverse vessel classes underscore its significant role in the global dry bulk shipping industry, facilitating efficient and flexible cargo solutions across the world.

4. PanOcean

Pan Ocean, a significant player in the dry bulk shipping industry, commands a fleet of 81 vessels, showcasing a formidable deadweight tonnage of approximately 11.3 million tons. This extensive fleet enables Pan Ocean to offer a wide range of shipping solutions globally, catering to diverse bulk commodities like grains, coal, iron ore, and steel products.

The company’s operational ethos is grounded in efficiency, safety, and environmental responsibility, positioning it as a dependable partner for long-term shipping contracts.

In 2023, Pan Ocean continued to emphasize its strategic focus on owned and bareboat charters, enhancing its service offerings and operational capabilities in the dry bulk sector. This approach aligns with its commitment to sustainability and excellence in maritime logistics, further solidifying its leadership position in the industry.

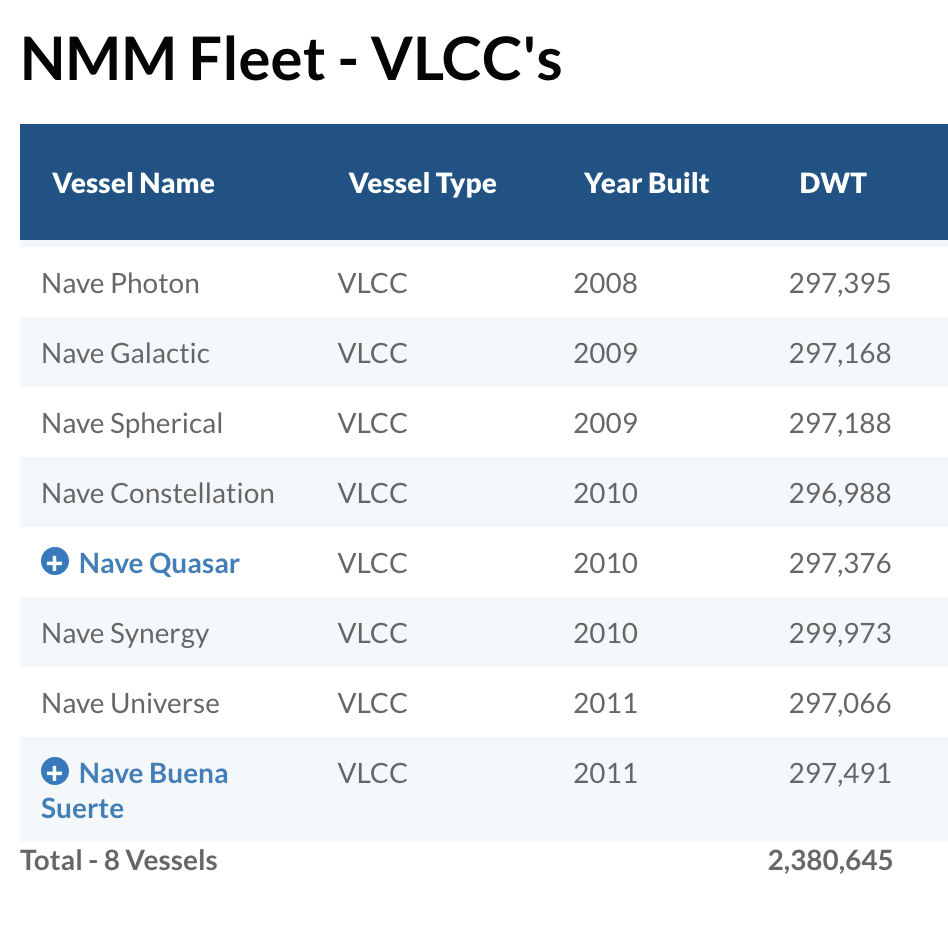

Navios Maritime Partners L.P. has strategically positioned itself within the dry bulk shipping industry, boasting a fleet of 71 vessels with a total deadweight tonnage of 9,173,758 DWT as of 2024. This extensive fleet underscores the company’s significant presence in the sector, although it operates a diversified portfolio that includes containerships and oil tankers, beyond just dry bulk carriers.

The dry bulk fleet comprises 35 Capesize, 30 Panamax, and 4 Ultra-Handymax class bulkers, demonstrating Navios Partners’ capacity to handle a wide range of bulk commodities efficiently. Additionally, the company’s venture into container shipping is notable, with a capacity of 215,222 TEU, highlighting its versatility and strategic expansion into various segments of maritime transport. The oil tanker fleet includes 11 VLCCs, further diversifying its operational capabilities and enhancing its service offerings in the global shipping market.

Navios Maritime Partners’ diversified fleet not only strengthens its position in the dry bulk sector but also enables it to meet a broad spectrum of shipping needs, reflecting its adaptability and commitment to serving the global supply chain effectively.

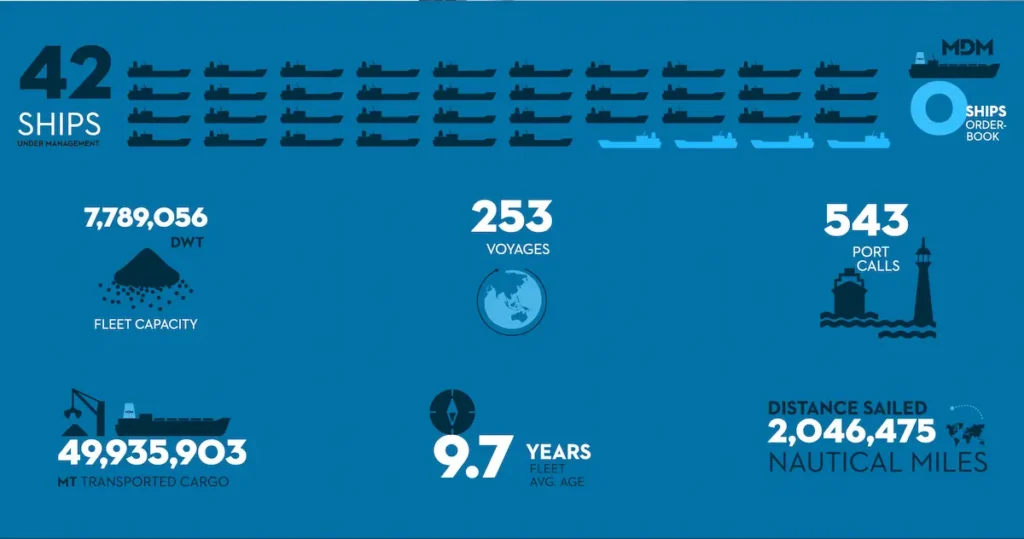

6. Maran Dry Management

Maran Dry Management, with a focused fleet of 42 owned and bareboat (BB) vessels, commands a significant presence in the maritime industry with a total fleet deadweight (DWT) of 7,960,737 tons.

Specializing in dry bulk transportation, Maran Dry Management leverages its substantial fleet to provide efficient and reliable shipping solutions across the globe.

The company’s dedication to operational excellence and its strategic fleet composition underscore its role as a key player in the global dry bulk sector. For a detailed view of their fleet, visit Maran Dry Management’s Fleet List.

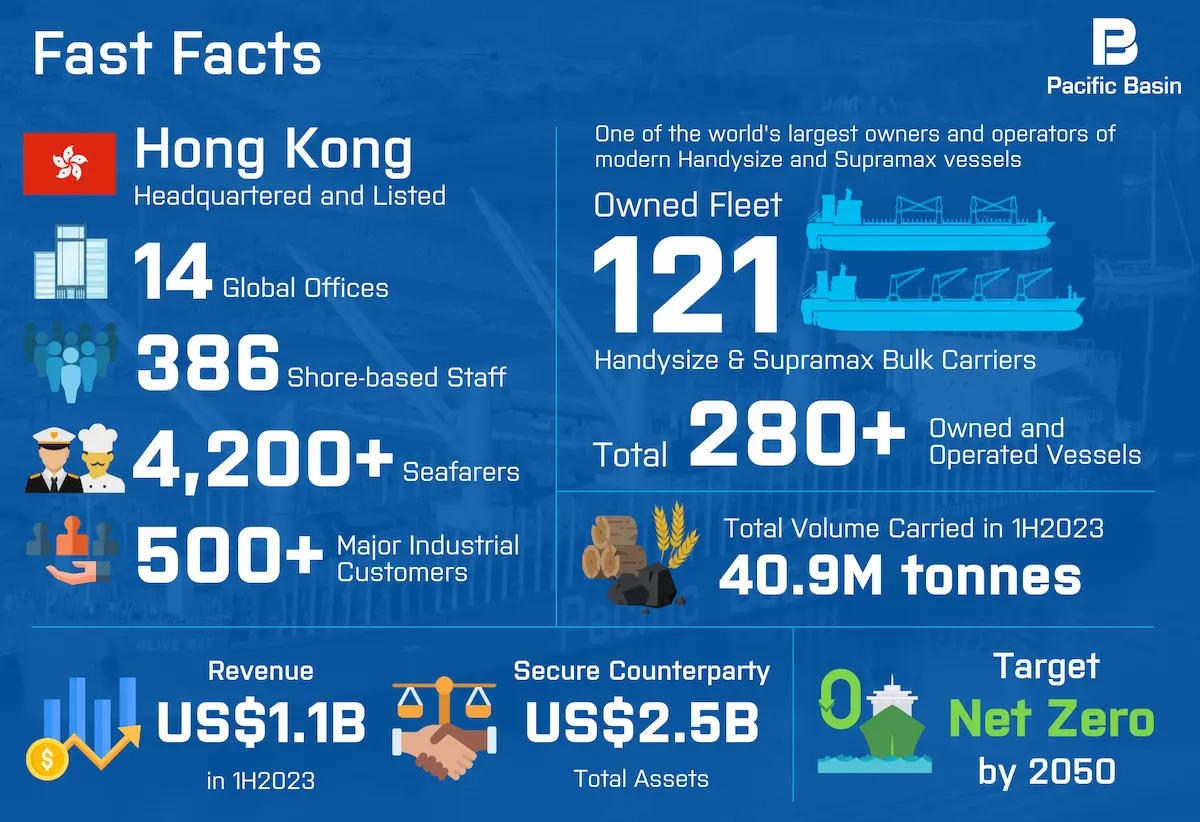

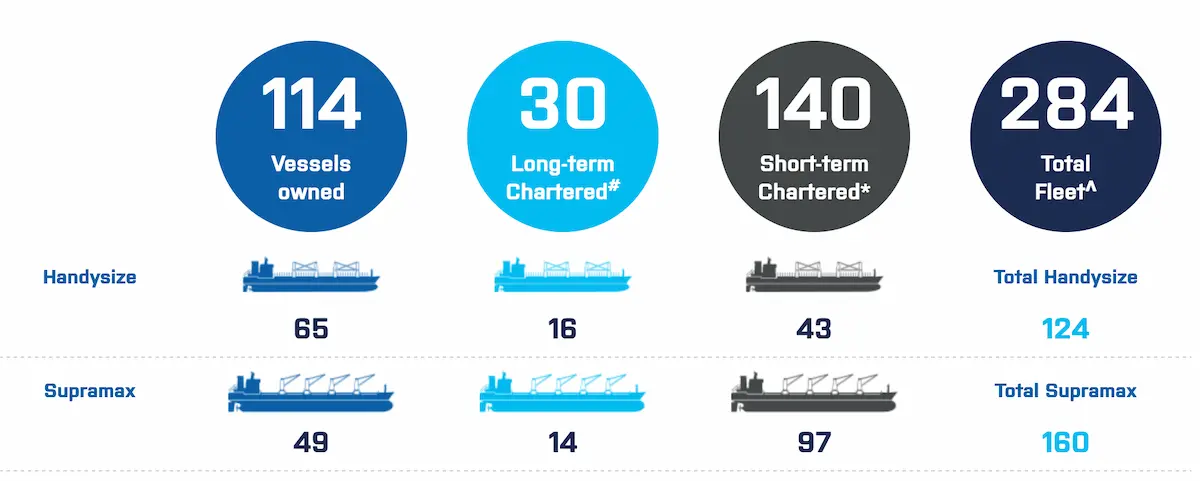

7. Pacific Basin Shipping Limited

Pacific Basin Shipping, headquartered in Hong Kong and led by Martin Fruergaard since July 31, 2021, is a leading maritime transport company specializing in the operation of Handysize and Supramax vessels.

With a robust fleet of 115 owned and bareboat (BB) vessels, Pacific Basin boasts a total fleet deadweight (DWT) of 5,237,570 tons. The company’s core fleet, primarily log or grab-fitted, highlights its operational versatility and efficiency, significantly reducing the need for ballast voyages.

Pacific Basin’s strategic approach to growth is evident in its recent fleet expansion, including the anticipated delivery of two 40,000MT dry bulk carriers from Imabari shipyard in the second half of 2023, alongside holding purchase options for several Handysize and Supramax vessels.

This strategic fleet management and expansion underscore Pacific Basin’s commitment to outperforming market indices and strengthening its position in the global dry bulk shipping sector. For more details on their fleet, visit Pacific Basin Shipping’s Fleet List.

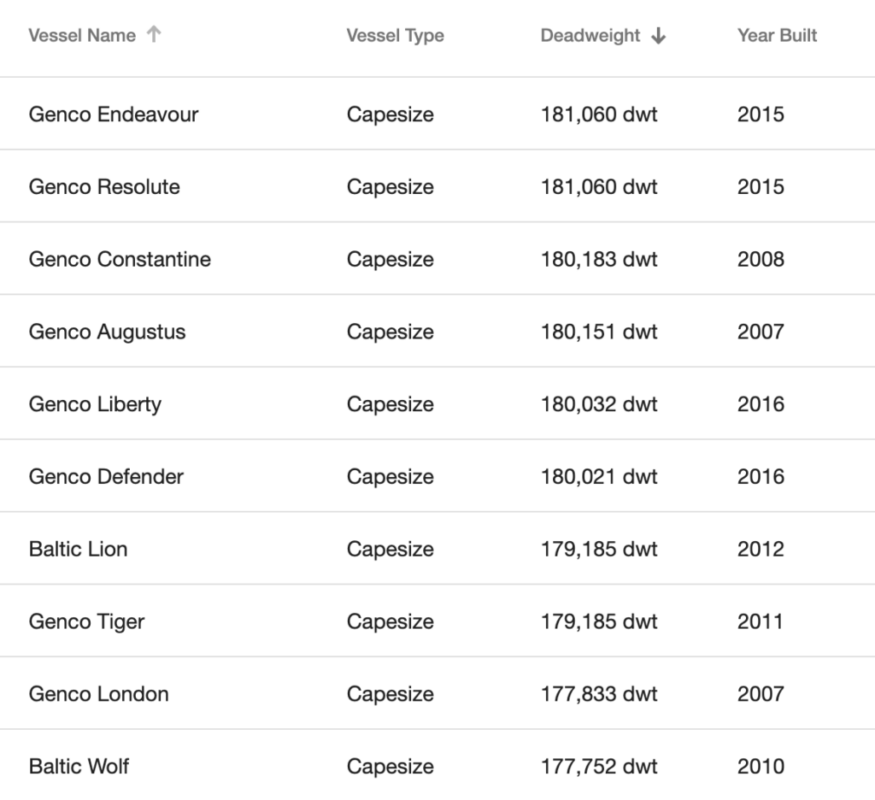

8. Genco Shipping & Trading Ltd.

Genco Shipping & Trading Ltd. stands as a formidable entity in the dry bulk shipping industry, with a strategic focus on expanding its presence among the top-tier companies.

As of the latest update, Genco’s fleet comprises 46 owned and bareboat (BB) vessels, showcasing a significant increase in its operational capacity with a total fleet deadweight (DWT) of 4,997,089 tons.

The company’s diversified fleet includes Capesize, Ultramax, and Supramax class vessels, reflecting its commitment to versatility and efficiency in bulk cargo transportation.

Genco’s strategic fleet composition and ongoing efforts to enhance its fleet size and capabilities underscore its ambition to solidify its position as a leader in the global dry bulk sector. For an in-depth look at their current fleet, visit Genco Shipping & Trading Ltd.’s Fleet List.

9. Diana Shipping

Diana Shipping Inc., a leading Greek dry bulk shipping company listed on the New York Stock Exchange, operates a diverse fleet of 43 vessels with a total deadweight of 4,821,511 tons.

The fleet includes Newcastlemax, Capesize, Post-Panamax, Kamsarmax, and Panamax class bulkers, reflecting the company’s focus on modernity and quality. With a strategy rooted in market dynamics and fleet expansion, Diana Shipping aims to enhance shareholder value through operational efficiency, safety, and environmental responsibility.

The company’s long-term charter approach with global commodity leaders provides stable cash flows and reduces market volatility exposure. For more information on their fleet, visit Diana Shipping Inc.’s Fleet List.

10. Safe Bulkers Inc.

Safe Bulkers specializes in dry bulk vessels and in early 2024 owned high quality and well-maintained fleet that included 47 dry bulk vessels consisting of 10 Panamax, 11 Kamsarmax, 18 Post-Panamax and 8 Capesize class vessels with a total deadweight of 4.8 million dwt.

The orderbook of the Safe Bulkers consists of 7 dry bulk vessels including two dual-fuel vessels with an aggregate carrying capacity of 1.0 million dwt.

Safe Bulkers is set to expand its fleet with 7 new dry bulk vessels, including two dual-fueled ships with a total capacity of 1 million dwt, from Q1 2024 to Q1 2027. These vessels meet the latest environmental standards, including IMO’s EEDI Phase 3 for reduced emissions and NOx Tier III regulations. The dual-fueled ships, capable of running on methanol, can achieve near-zero greenhouse gas emissions, aligning with the well-to-propeller assessment.

Fednav deserves a special place in the list of the largest dry bulk shipping companies. Being in11th place on the list as an international leader in ocean shipping, Fednav operates in key areas – the Great Lakes and the Canadian Arctic that have ice navigation, therefore their fleet has various ice classes.

Look at the conditions these vessels have to sail in the Arctic region and proceed to the terminal for berthing and further loading. This timelapse video was made on the 200-meter-long bulker Federal Kumano.

The FedNav fleet consists of 97 owned ships including several lakers and Handysize, Supramax, and Ultramax class dry bulk carriers with a total deadweight of 4,2 million tons.

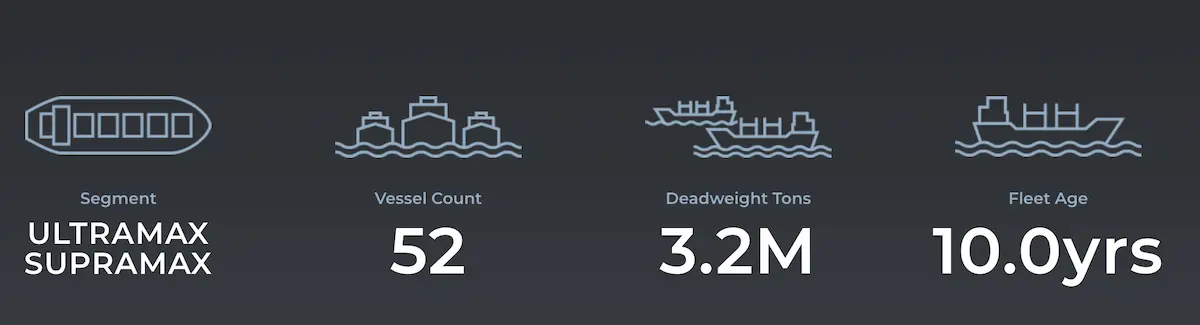

12. Eagle Bulk Shipping Inc.

Eagle Bulk Shipping Inc. is a US-based fully integrated shipowner-operator with headquarters in Stamford, Connecticut, and offices in Singapore and Copenhagen.

Eagle Bulk Shipping fleet focuses exclusively on the mid-size dry bulk vessel segment and owns 26 Ultramax and 27 Supramax class bulkers and claims the status of one of the largest fleets of Supramax and Ultramax class ships in the world. Today, the fleet of Eagle Bulk Shipping lists a total of 52 bulkers with 3.16 million tons of deadweight.

Supramax/Ultramax vessels are considered to be the most versatile among the various dry bulk ship types due to both their size and specifications.

In its industry analysis, the company displays that its market choice is data-driven. Eagle Bulk Shipping highlights the benefits of the dry bulk cargo transportation market volume and Supramax/Ultramax class bulker fleet flexibility.

13. Seanergy Maritime Holdings

Seanergy Maritime Holdings is another great example of a company focused on one class of bulkers in its fleet. The fleet consists of 17 Capesize dry bulk carriers, but a total deadweight of 3,054,820 tons lets them be included in the list of the top 15 of the largest dry bulk shipping companies.

This company has two “flagships” – Capesize class bulker MV Flagship with 176387 tons deadweight and their flagship by size – MV Patriptship with 181709 dwt capacity.

14. Eastern Mediterranean Maritime Limited

Eastern Mediterranean Maritime Limited (EASTMED) is a ship management company based in Glyfada, Athens, Greece. With over 40 years in the business, EASTMED manages a diverse fleet that includes 41 vessels comprised of tankers, dry bulk carriers, and container ships, totaling a DWT capacity of close to 3 million tons.

The company is a significant provider of seaborne transportation services across the energy, industrial, and agricultural sectors, known for the quality of its services and operational excellence.

EASTMED’s extensive fleet is primarily engaged in the spot market, though it also engages in short-term charter agreements.

15. Himalaya Shipping

Himalaya Shipping holds the 15th position in the ranking of dry bulk shipping companies, with a focused fleet of 12 vessels. These ships collectively boast a total deadweight tonnage (DWT) of 2,520,000 tons, indicating Himalaya Shipping’s capacity to transport a significant volume of dry bulk commodities. Although smaller in fleet size compared to its competitors, the company plays a vital role in the global maritime logistics chain, specializing in the transportation of essential bulk materials such as minerals, grains, and coal. Himalaya Shipping’s strategic positioning and operational efficiency enable it to contribute effectively to the international trade of bulk goods, underscoring its importance in the dry bulk shipping sector.

Runner-Up: Saga Welco

A unique offer on the market is provided by Norwegian shipowner Saga Welco. A global shipping company operates a modern fleet of 49 open-hatch gantry crane vessels for the transportation of forest products, breakbulk, and bulk cargoes.

Each vessel is equipped with 2 sets of traveling gantry cranes with weather protection with a capacity from 40 to 70 tons.

Our Methodology

In our pursuit to rank the largest companies in the dry bulk shipping industry, we have chosen to focus on what we define as the “Core Fleet” for each company. This approach centers on ships that are either owned outright by the company or are under bareboat charter agreements.

Why Core Fleet? We believe that the Core Fleet represents the most stable and directly controllable assets of a shipping company. Owned ships are the backbone of any maritime operation, reflecting the company’s long-term investment in the dry bulk shipping sector. Similarly, bareboat chartered ships, though not owned, offer companies substantial operational control, akin to ownership, for the duration of the charter. This combination provides a clear picture of a company’s foundational capacity and its commitment to the industry.

Exclusions: While time-chartered and voyage-chartered vessels play significant roles in a company’s operational flexibility and its ability to meet market demands, they introduce variability and short-term fluctuations that can obscure the underlying size and strength of a company’s fleet. Therefore, we have opted to exclude these from our primary ranking criteria.

Our methodology aims to offer a transparent, consistent, and stable basis for comparison, focusing on the core assets that companies maintain over the long term. This approach allows for a clearer understanding of each company’s position within the industry, based on the size and control of their Core Fleet.

- Sustainable and Luxurious: Discovering Split’s Yachting Paradise – April 26, 2024

- MarineTraffic vs VesselFinder: Which Is Better Vessel Tracking Service? – February 14, 2024

- Port Costs: A Comprehensive Guide to Port Dues and Fees for Cargo Ships – February 12, 2024

Leave a Reply