Container ports remain vital to the United States economy, serving as crucial hubs for the country’s imports and exports.

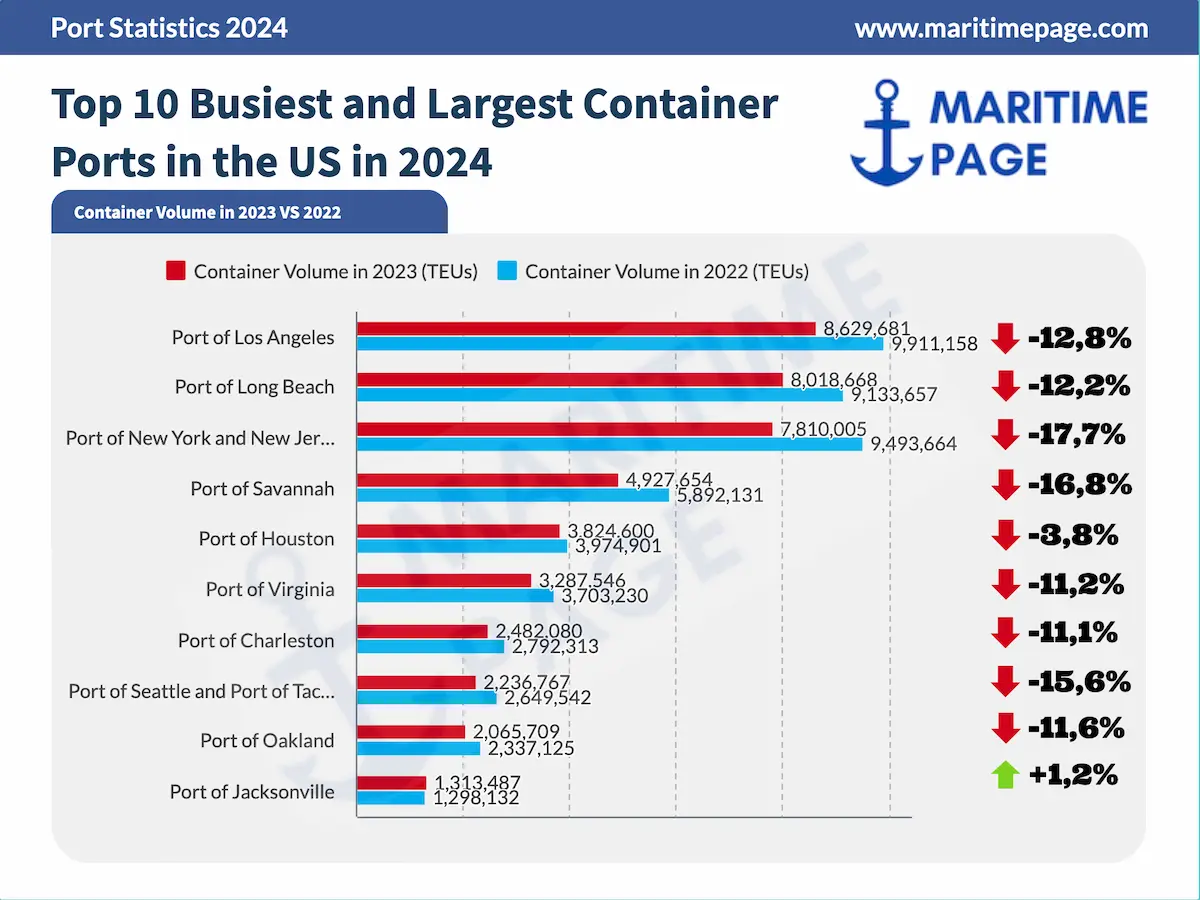

In 2023, although the total container traffic handled by US ports is yet to be confirmed, preliminary estimates suggest a decrease of approximately 14% from the 2022 figure, which stood at around 60 million TEUs (twenty-foot equivalent units). This reduction reflects a shift from the substantial growth observed in the previous year.

Despite the decrease in overall volume, the United States continues to maintain a robust and competitive container port industry.

The top 10 busiest container ports in the US play a particularly significant role, accounting for roughly 80% of the nation’s total container traffic. These ports facilitate a vast majority of the maritime trade and reflect broader economic trends and challenges.

The following table presents the latest reported container volumes for the top 10 busiest and largest container ports in the United States, highlighting their contributions and changes in container traffic compared to the year 2022.

| Port Rank | Port Name | Container Volume in 2023 (TEUs) | Change to 2022 |

|---|---|---|---|

| 1 | Port of Los Angeles | 8,629,681 | -1,281,477 |

| 2 | Port of Long Beach | 8,018,668 | -1,114,989 |

| 3 | Port of New York and New Jersey | 7,810,005 | -1,683,659 |

| 4 | Port of Savannah | 4,927,654 | -964,477 |

| 5 | Port of Houston | 3,824,600 | -150,301 |

| 6 | Port of Virginia | 3,287,546 | -415,684 |

| 7 | Port of Charleston | 2,482,080 | -310,233 |

| 8 | Port of Seattle and Port of Tacoma | 2,236,767 | -412,775 |

| 9 | Port of Oakland | 2,065,709 | -271,416 |

| 10 | Port of Jacksonville | 1,313,487 | 15,355 |

1. The Port of Los Angeles

The Port of Los Angeles, situated in San Pedro Bay, 20 miles south of downtown Los Angeles, retained its status as the busiest container port in the US for the 24th consecutive year in 2023.

Despite global trade fluctuations, it processed 8,63 million TEUs in 2023, marking a decrease of around 12,9% from the 9.91 million TEUs handled in 2022. This reduction is in line with a general decline in trade observed in most categories at ports globally.

2023 was a year of resilience for the Port of Los Angeles. After experiencing a decrease in cargo volume in the earlier part of the year, it ended on a high note with five consecutive months of year-over-year gains.

In December 2023 alone, the port processed 747,335 TEUs, which was 2.5% higher than the previous year. This included an increase in loaded imports by 5% and a significant rise in loaded exports by 26%, compared to 2022. However, there was an 8.5% decrease in empty containers.

In 2023, the Port of Los Angeles focused on significant advancements despite the overall decline in trade. Executive Director Gene Seroka emphasized plans for 2024, including a substantial $2 billion capital improvement program and technological enhancements for increased efficiency and reduced environmental impact. These efforts aim to generate more jobs and enable further community reinvestment.

As a pivotal economic force in Southern California, the Port of Los Angeles plays a critical role in global trade, especially with Asia. It maintains its commitment to state-of-the-art operations and environmental stewardship while handling a wide array of cargoes.

2. Port of Long Beach

In 2023, the Port of Long Beach handled a total of 8,018,668 TEUs, which marked a decrease of 12.2% from the previous year.

This downturn was reflected in various categories, with import volumes declining by 12.7% to 3,804,356 TEUs and exports dropping by 9.4% to 1,282,437 TEUs.

The movement of empty containers also decreased by 12.7% to 2,931,876 TEUs. Despite this decline, the port’s performance surpassed pre-pandemic levels reported in 2019.

The Port of Long Beach continues to be a crucial player in the Transpacific trade, with an annual trade value of approximately $200 billion and supporting 2.6 million jobs across the United States, including 575,000 in Southern California.

One of the major terminals at the Port of Long Beach is the Long Beach Container Terminal (LBCT), which is one of the most technologically advanced container terminals in the world. The terminal features 10 ship-to-shore cranes and 50 rubber-tire gantry cranes and has a capacity of 3.3 million TEUs annually. The terminal is a major hub for trade between Asia and the US.

The port has made significant investments in environmental sustainability, including implementing a Clean Air Action Plan to reduce air pollution and a Green Port Policy to promote environmental stewardship. The port has also set ambitious goals to reduce greenhouse gas emissions and increase the use of zero-emission technologies.

The Port of Long Beach has experienced strong growth in recent years, with over 8.1 million TEUs handled in 2021 which was improved during 2022 with over 9,1 million TEUs handled in 2022. The port has also set several records, including handling over 700,000 TEUs in a single month in August 2021.

3. Port of New York and New Jersey

In 2023, the Port of New York and New Jersey experienced a notable shift in its cargo handling dynamics compared to 2022. While it remained a vital economic hub, the port faced a decrease in total cargo volume.

For the year 2023, the port moved 7,810,005 TEUs, representing a significant decrease of 17.7% compared to 2022. This downward trend was consistent throughout the year.

October 2023 was the busiest month for the port in the year, moving 742,571 TEUs, yet this was still a 6.3% decrease compared to October 2022. The decline was evident across various cargo categories, with imports showing a 19.6% decrease from January through October 2023 compared to the same period in 2022. Exports also decreased slightly by 1.6% in the same comparison.

Despite these challenges, the port maintained its position as a major gateway to the Northeast region of the US, handling a diverse range of cargoes. Its strategic location and state-of-the-art facilities, including the Port Newark Container Terminal and the Maher Terminals, continued to provide efficient access to major population centers and transportation networks.

The port’s commitment to environmental sustainability also remained a key focus, as it continued to implement strategies to reduce emissions and promote clean energy usage in its operations.

4. Port of Savannah

In 2023, the Port of Savannah experienced a decrease in container traffic compared to the previous year. The port handled 4,927,654 TEUs (twenty-foot equivalent units), a decline from the 5,892,131 TEUs processed in 2022 by 16,8%. This represents a significant shift in volume, reflecting broader economic and logistical trends impacting the port’s operations.

The Port of Savannah, pivotal to the United States’ maritime trade, underwent notable developments in 2023. As North America’s fourth-largest and the East Coast’s second-largest seaport, it initiated a comprehensive $1.9 billion infrastructure expansion. Key projects included enhancing the Garden City Terminal’s capacity by 1.2 million TEUs and adding 90 acres to the Garden City West Terminal. The reopening of Berth 1 after extensive renovations now enables the port to accommodate ships exceeding 16,000 TEUs.

Furthermore, the Mason Mega Rail Terminal, finalized in 2022, significantly uplifts the port’s rail lift capacity to one million containers annually. Strategic partnerships, like the collaboration with CSX and the forthcoming Blue Ridge Connector inland rail terminal, due in 2026, aim to strengthen the port’s logistical network.

These advancements, coupled with the Hyundai Motor Group’s construction of a nearly $6.9 billion electric vehicle assembly and battery plant, underscore the Port of Savannah’s role in stimulating regional economic growth and industrial real estate development. In 2023, the port’s influence was marked by over 13.8 million square feet of newly leased construction space, indicating its centrality in the U.S. transportation infrastructure and its expanding impact on the broader economy.

5. Port of Houston

In 2023, the Port of Houston, a cornerstone of U.S. maritime trade, sustained its position as the fifth busiest container port in the nation, despite a slight decrease in container traffic. Handling 3,824,600 TEUs (twenty-foot equivalent units), it saw a marginal reduction from its 2022 volume of 3,974,901 TEUs. As the largest port in the Gulf of Mexico, it continued to play a pivotal role in the economic landscape of the region.

The port’s substantial economic impact, supporting over 1.35 million jobs and generating more than $265 billion in economic activity annually, remained a key factor in its prominence. Serving as a major hub for international trade, the Port of Houston handled a diverse array of containerized goods, including chemicals, petroleum, and machinery, underlining its versatility and strategic importance.

Featuring state-of-the-art facilities such as the Bayport Container Terminal, the port exemplified technological advancement and operational efficiency. The terminal’s automated systems and advanced equipment facilitated smooth cargo transportation, reinforcing the port’s reputation for efficiency. Notably, the port’s commitment to sustainability and environmental stewardship continued to be recognized, as evidenced by awards like the Green Port Award and initiatives like the Houston Clean Air Strategy.

Overall, the Port of Houston remained an indispensable element of the U.S. transportation infrastructure in 2023, bridging businesses with global markets and fostering regional economic growth and development.

6. The Port of Virginia

In 2023, the Port of Virginia remained a significant player in the United States maritime sector, consistently holding its position as the sixth-largest container port in the country. During this period, the port managed a total container traffic of 3,287,546 TEUs, a slight decrease from the 3,695,156 TEUs recorded in 2022. This adjustment reflects broader shifts in global trade dynamics and operational challenges.

Strategically located along the East Coast with unobstructed access to the Atlantic Ocean, the Port of Virginia continued to facilitate efficient cargo handling, capitalizing on its deep-water channels and advanced infrastructure. Its primary terminals, including Norfolk International Terminals (NIT), Virginia International Gateway (VIG), and Newport News Marine Terminal (NNMT), remained pivotal in offering comprehensive container services.

The port’s reputation as a hub for diverse cargo types, ranging from automotive parts to consumer goods, was further solidified in 2023. Its commitment to developing robust supply chain solutions and maintaining strong partnerships with ocean carriers, shippers, and logistics providers contributed to its status as a key destination for global trade and a vital economic driver for the region and the nation.

7. Port of Charleston

The Port of Charleston is located in South Carolina and is the eighth busiest container port in the US, handling over 3 million TEUs in 2021. It is also a major port for automobile imports and exports.

The port is an economic engine for the region, supporting over 187,000 jobs and generating more than $17 billion in economic activity annually. It has several terminals, including the Wando Welch Terminal, which is the port’s largest and most technologically advanced terminal. The terminal features 13 ship-to-shore cranes, 52 rubber-tired gantry cranes, and an on-dock rail facility, which allows for efficient transportation of cargo to and from the terminal.

The Port of Charleston has received numerous awards for its operational efficiency and commitment to environmental stewardship. It is also expanding its infrastructure to accommodate larger vessels and increasing cargo volumes. In 2021, the port opened the Hugh K. Leatherman Terminal, which is the first new terminal in the US in more than a decade. The terminal features five ship-to-shore cranes and 25 hybrid rubber-tired gantry cranes, making it one of the most technologically advanced container terminals in the country.

Overall, the Port of Charleston is a vital link in the US transportation network, connecting businesses and consumers to global markets and supporting economic growth and development in the region.

8. Port of Seattle-Tacoma

In 2023, the Port of Seattle-Tacoma, known as the Northwest Seaport Alliance, retained its status as the seventh busiest container port in the United States. The port’s container volume for the year stood at 2,236,767 TEUs, a decrease from the 2,649,542 TEUs handled in 2022. This change reflects the dynamic nature of global trade and operational challenges faced during the year.

Strategically situated in the Pacific Northwest, the Port of Seattle-Tacoma serves as a key gateway for Asia-U.S. trade. The port supports over 58,000 jobs and generates significant economic activity, underlining its importance in the region. Its four major container terminals, equipped with 13 post-Panamax cranes, can accommodate some of the largest container ships in the world.

In 2023, the port continued its commitment to infrastructure development and environmental sustainability. Projects like the Terminal 5 modernization, aimed at handling larger vessels, and the Terminal 18 redevelopment, designed to increase cargo capacity and operational efficiency, highlight the port’s dedication to enhancing its capabilities. Moreover, the port’s initiatives in reducing environmental impact, including the adoption of shore power and cleaner fuels, reinforce its commitment to sustainable operations.

9. Port of Oakland

In 2023, the Port of Oakland continued to serve as a crucial gateway for trade, particularly with Asia, despite experiencing a decrease in container volume. Handling 2,065,709 TEUs, it maintained its position as the ninth busiest container port in the US. This volume represents an 11.6% decline compared to the 2,337,125 TEUs managed in 2022. The port’s strategic location in the San Francisco Bay Area remained vital for exports such as agricultural products, wine, and technology.

Infrastructure investments, including crane heightening projects and a new rail yard, showcased the port’s commitment to accommodating larger vessels and enhancing intermodal connectivity. Environmental initiatives, like electrifying cargo handling equipment and implementing a truck management program, continued to reflect the port’s dedication to sustainability.

Despite the challenges posed by global trade dynamics, the Port of Oakland remained resilient. Its strategic location and ongoing investments in infrastructure and environmental sustainability ensured its status as a critical link in the global supply chain, reinforcing its role in connecting businesses and consumers with international markets.

10. Port of Jacksonville

In 2023, the Port of Jacksonville (JAXPORT) solidified its position as a leading U.S. container port, ranking as one of the top 10 in the nation. Notably, JAXPORT distinguished itself by being the only major port to record an increase in container volume for the year. It handled a significant 1,313,487 TEU, marking a growth of 1.18% from the previous year.

The port’s recent developments extend beyond container handling. A significant milestone was the announcement of an additional cruise line set to operate from JAXPORT, joining the existing service by Carnival Cruise Line. This expansion in cruise services highlights JAXPORT’s versatility and its increasing appeal in the cruise industry.

Strategically, JAXPORT has made substantial progress in its 2020-2025 Strategic Master Plan, emphasizing diversification and growth across various cargo types and trade lanes. This plan includes new container services with Asia and Europe, reinforcing JAXPORT’s position as a vital gateway for international trade.

JAXPORT’s commitment to sustainability and modernization is evident in its recent initiatives. These include multi-million-dollar investments in eco-friendly cargo-handling equipment and infrastructure upgrades. Such efforts not only enhance operational efficiency but also align with global environmental standards, positioning JAXPORT for long-term success.

Statistics of the Container Ports in the US in 2023

Container ports remain vital to the US economy, serving as critical junctures for global trade. In 2023, despite global challenges and a slight decline in overall container volume, the top 10 busiest US ports demonstrated resilience and adaptability.

These ports, strategically positioned and diverse in their capacities, continue to facilitate a significant portion of the country’s trade flow.

The Port of Los Angeles and the Port of Long Beach, for instance, maintain their significant roles in trans-Pacific trade.

As the world navigates through changing economic landscapes, these ports will persist as key players in supporting and driving international commerce.

- Types of Gas Carriers as per IGC Code – April 22, 2025

- Wind-Assisted Propulsion Systems (WAPS): A Game Changer for Maritime Decarbonization – February 6, 2025

- 10 Boat Salvage Yards in California – January 25, 2025